How to Manage the VAT in Business Online in the EU

Sell digital products or services in the European Union involves a series of tax obligations that every online business should know. One of the main concerns of digital entrepreneurs is the correct application and statement of the VAT, a key aspect to legally operate and avoid penalties.

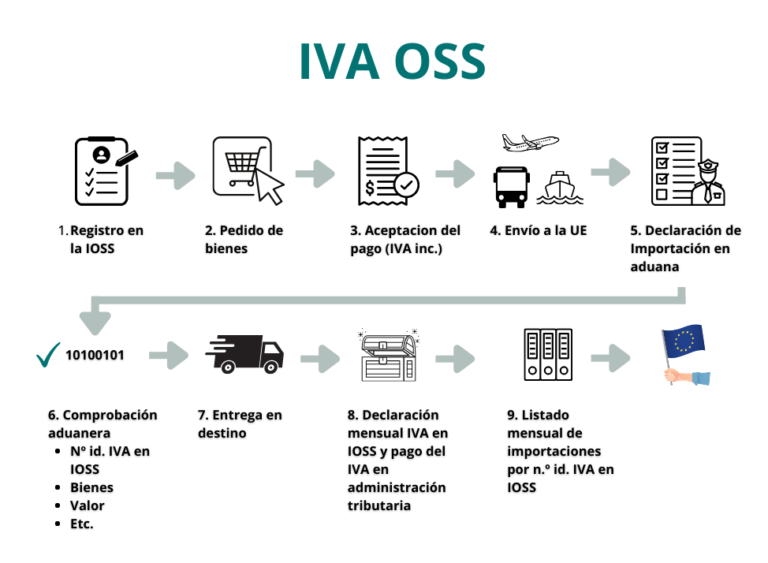

Fortunately, the regime OSS (One-Stop-Shop) facilitates the management of VAT on cross-border transactions, simplifying the process of registration and declaration for the vendors. In this article, we will explore how this system workswhat are the main tax obligations to business online and what tools can help you automate the compliance of these regulations.

What is the Regime OSS and How it Facilitates the Management of the VAT?

The regime OSS (One-Stop-Shop) is a system implemented by the European Union to simplify the payment of VAT on sales to final consumers in different countries of the EU. Before its implementation, the companies were required to register and file tax returns in each country where they exceed certain thresholds of sales. With the OSS, the process is centralized and it becomes a lot more simple.

Main advantages of the regime OSS:

Single log-in: It is not necessary to register in each country of sale, only-in-one.

Statement centralized: We report a unique quarterly statement with all the sales in the EU.

Payment simplified: Settles the VAT in the country of registration, and this is in charge of distributing it to other countries.

The OSS is optionalbut in most cases, its use is highly beneficial, as it reduces the administrative burden and the costs of tax compliance.

Tax obligations for Online Retailers in the EU

If you have an online business and sell to the end consumers in the EU, it is critical that you understand what your tax obligations:

1. Threshold of sales of € 10,000 per year

If your total sales to customers in the EU do not exceed this figure, you can apply the VAT rate of your country of origin. However, when you exceed this limit, you must apply the rate of VAT applicable to the buyer's country.

2. Application of the VAT rate of the country of the customer

Each EU country has different tax rates of VAT. For example, the standard rate in Germany is 19%, while in France is 20%. It is crucial to correctly calculate the VAT on each sale.

3. Records retention for 10 years

The regulations for european tax require that sellers maintain a detailed record of your transactions for at least a decade in the case of audits.

📌 Do you need more information about these requirements? Refer to the official regulations of the EU concerning VAT on digital business.

Tools to Automate the Management of VAT

The technology facilitates the management of the fiscal and enables online businesses to focus on growth without worrying about the administration of the VAT. There are several tools designed to automate the calculation and declaration of this tax:

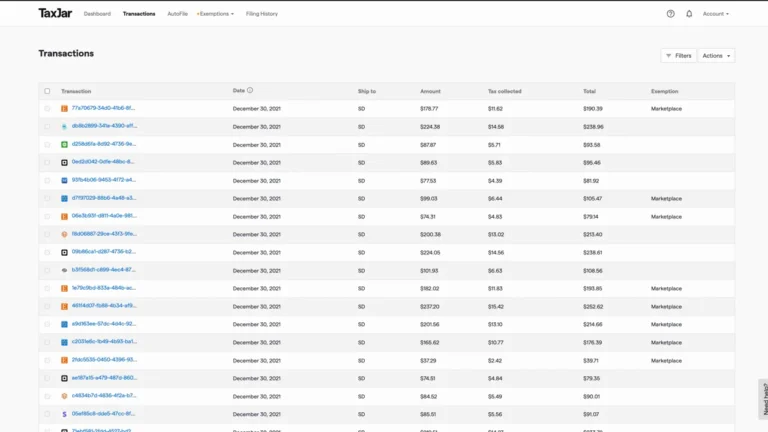

- TaxJar and Avalara: Ideal to calculate the VAT and generate tax reporting in different countries of the EU.

- QuickBooks Online: Complete solution that integrates financial management and accounting, including the declaration of VAT.

Implement these tools can save you time and minimize errors in tax compliance.

The Importance of a Strategy Tax Efficient

The proper handling of VAT on online business not only ensures legal compliance, but also optimizes the tax structure of the company, reducing risks and avoiding penalties. With the regime OSS and automation tools, it is possible to manage these obligations in a more simple and efficient.

📅 If you need personalized advice for the management of the VAT on your online business, consultation with an expert in international taxation.

¡Click here and let us guide you towards a fiscal management efficient and hassle-free!